When you have a child with special needs, estate planning requires special consideration. You'll need…

Understanding State Taxes Associated with Gifts, Estates, and Inheritances

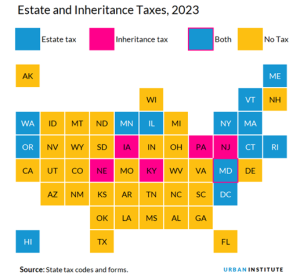

The state tax implications, encompassing gift, estate, and inheritance taxes, can fluctuate depending on the specific state of residence. Not all states impose these taxes, and those that do may have different rules and thresholds. These state taxes can be regularly subject to change, and it’s important to consult with an estate planning attorney to be current with your state laws as they relate to your estate plan.

Gift Tax

A gift tax is imposed on the transfer of property or assets during a person’s lifetime. While the federal government imposes a gift tax, not all states have one separately. If a state doesn’t have a gift tax, it may have different exemption thresholds and tax rates than the federal gift tax. Some states with a gift tax include:

- Connecticut

- Kentucky

- Maryland

- New York

Other states may have estate taxes that include lifetime gifts in their calculations. To know what the gift tax laws are in your state, consult with your estate planning attorney.

Estate Tax

An estate tax is a tax on the transfer of assets upon a person’s death. Similar to gift tax, not all states have estate taxes, and those that do may have different exemptions and tax rates. The states that currently have estate taxes include:

- Connecticut

- Hawaii

- Illinois

- Maine

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

It’s important to understand that the federal government also has an estate tax, but the exemption threshold is still relatively high and only applies to larger estates. The exemption rate will be nearly halved on January 1, 2026.

Inheritance Tax

Inheritance tax differs from an estate tax because it’s levied on the beneficiaries of inheritance rather than the estate itself. Not all states have an inheritance tax, and the rules can vary significantly among those that do. The relationship between the decedent and the recipient can affect the tax rate or exemption threshold.

The states with inheritance tax include:

- Iowa

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

Legal guidance regarding state laws is paramount to obtaining accurate and up-to-date information regarding gift, estate, and inheritance taxes. State tax laws can change, and a general overview can’t address many nuances and exceptions that may apply to your circumstances.

Should You Relocate For Retirement?

While federal estate taxes are unavoidable in every US state, not all states require gift, estate, or inheritance taxes at the state level. Depending on your financial circumstances, relocating to a tax-friendly state to minimize your heirs’ tax situation can be an advantage.

What State Law Applies for Tax Purposes?

The inheritance tax an heir must pay ties to the deceased’s home state. It doesn’t matter if heirs live in a different state. You may be exempt from inheritance taxes depending on your relationship to the decedent. Qualifying for the exemption is mostly for a spouse and, in the case of New Jersey, domestic partners. In many states, exemptions for children are also fairly generous.

While gift tax accrues from gifting during your lifetime, estate and inheritance taxes apply after your death. An estate planning attorney can advise which state’s estate and inheritance tax laws can best benefit your estate and minimize your heirs’ tax consequences.

An estate planning attorney can provide a comprehensive understanding of state tax consequences as they relate to your estate and tailor a plan to minimize tax liabilities while still achieving your estate planning goals.

An estate planning attorney can provide a comprehensive understanding of state tax consequences as they relate to your estate and tailor a plan to minimize tax liabilities while still achieving your estate planning goals.

Estate Planning Attorneys Can Help

An estate planning attorney’s knowledge of specific state laws and regulations can help you amend your estate plan as regulations and laws change.

Tax Planning Strategies

Estate planning attorneys can develop tax planning strategies tailored to your situation. They can advise you on minimizing potential tax liabilities, taking advantage of available exemptions and deductions, and structuring your estate plan efficiently. They can also help you understand the potential consequences of different estate planning decisions.

Gift Tax Planning

If you’re considering making significant gifts during your lifetime, an estate planning attorney can guide you through your state’s gift tax rules and exemptions. They can help you determine the most tax-efficient ways to transfer assets and maximize available exclusions to minimize gift tax liabilities.

Estate Tax Planning

Individuals with larger estates can consult an estate planning attorney to assist in developing strategies to minimize estate tax liabilities. They can help you understand the applicable state estate tax thresholds, exemptions, and rates and create a comprehensive estate plan considering these factors. Estate tax burdens may be reduced using tools such as trusts, gifting strategies, and charitable giving.

Inheritance Tax Planning

In states with inheritance taxes, an estate planning attorney can help you navigate the complex rules and regulations. They can explain how the tax applies based on your relationship with the decedent and advise on available exemptions or deductions to help structure your estate plan and minimize the impact of inheritance taxes on your beneficiaries.

Compliance and Documentation

Estate planning attorneys can ensure your estate plan is properly documented and legally structured to comply with state tax laws. They can assist with preparing and filing necessary tax forms, such as gift or estate tax returns, and help you meet important deadlines to avoid penalties or interest.

Work with our experienced estate planning attorneys for a comprehensive understanding of state tax consequences and a tailored plan to minimize tax liabilities while achieving your estate planning goals. We hope you enjoyed this article. If you would like to discuss a personal legal matter, we would be happy to talk. Please contact our Heber Springs, Arkansas Office at (501) 365-3934.